Leveraging Audience Data to Make KOHLER Home Energy a Household Name

Increasing Lead Generation Efficiency by Leveraging Backup Power’s Biggest Audiences

Kohler wanted to target potential customers with the strongest likelihood of purchasing a generator. While we understood our audience as a whole and knew who was most likely to become a lead, we hadn’t yet used data to prove who was actually buying a generator—and if that differed. So, we analyzed 2+ years of first-party and third-party data to generate new, informed audience segments to more efficiently drive sales.

The Challenge

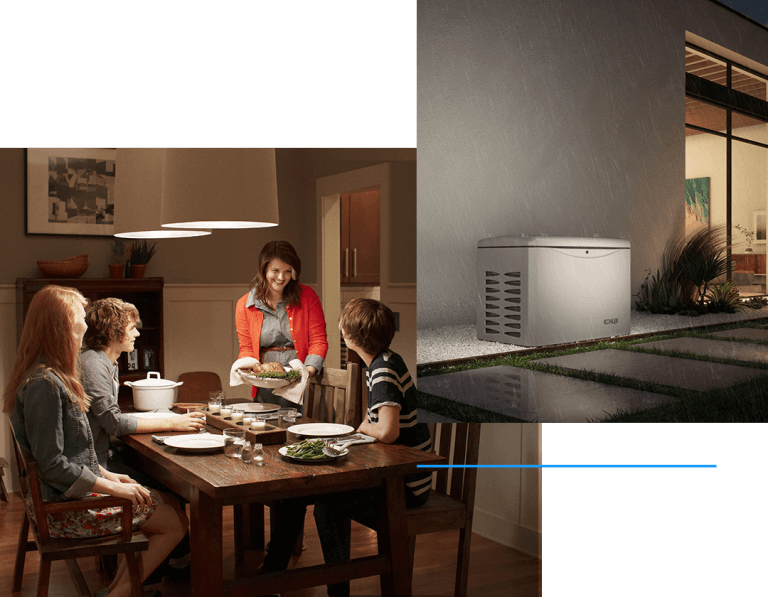

KOHLER Home Energy, an industry leader in safe, reliable backup power solutions for households across the U.S. and Canada, needed a more efficient digital strategy for reaching and converting potential customers. They wanted to know who was most likely to purchase a KOHLER generator, where those priority customers lived and what digital platforms they favored for searching, scrolling and shopping for home services.

Our Solution

Enter TriMark’s pioneering data analysis model, designed for a top-to-bottom exploration of client sales and third-party data. Here’s how we determined our metrics for analysis and turned our insights into refined consumer audience segments and a nimble, multichannel targeting strategy.

- Step 1: Building A Model for Comprehensive Data Analysis

- Step 2: Using Income-Based Clustering to Locate Our Customers Online

- Step 3: Refining Audience Profiles By Personifying Data

- Step 4: Incorporating Audience-Specific Messaging into Our Media Strategy

Step 1

Building A Model for Comprehensive Data Analysis

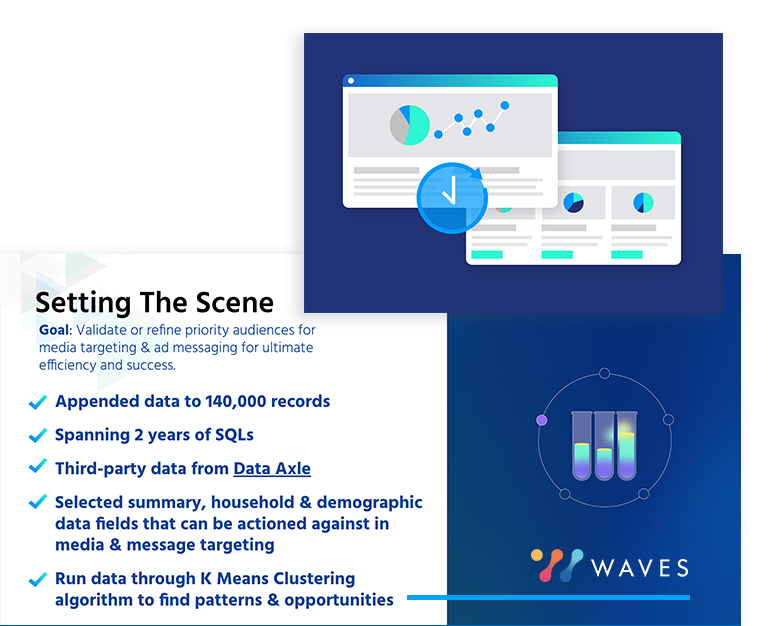

To uncover purchasing patterns and motivations in KOHLER’s consumer base, we developed a rigorous plan for digging into the data. Sourced from over two years’ worth of Sales Qualified Leads (SQLs) and thoughtfully selected third-party consumer data, our team performed a K Means Clustering algorithm engineered to identify natural segmentations in our converted customer category.

The analysis identified two naturally-forming, wealth-positioned clusters, with specific data we could use to redefine our high-converting primary audiences.

Step 2

Using Income-Based Clustering to Locate Our Customers Online

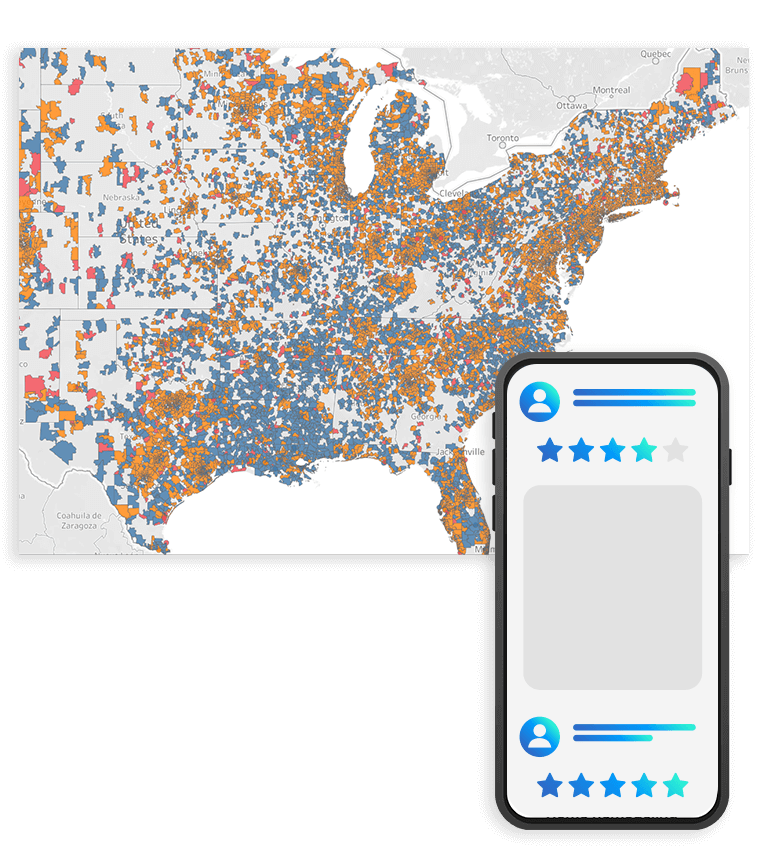

Our income-based clusters revealed some consistency in where our target audience members live. Unsurprisingly, consumers with a higher HHI are largely located close to or within major metropolitan areas; their counterparts with a slightly lower HHI tend to live more rurally. But we wanted to go beyond geographic placement and learn where KOHLER’s customers lived online, too.

According to our analysis, higher-income audience members are more likely to convert through intent-driven, educational or branded channels like email and organic search and social. These individuals typically research a brand or product before converting more than those with a lower household income. Our second group of audience members—those with less disposable income—are less likely to spend as much time on brand and product research, converting more often through paid platforms, such as Meta, with an accessible form fill option. It’s worth noting, however, that this group places a higher value on customer reviews when considering a major purchase, relying on real people to inform their decision more than a brand’s site or branded messaging. Ultimately, all of this informed the way we crafted creative assets and messaging, as well as where we deployed them.

Step 3

Refining Audience Profiles By Personifying Data

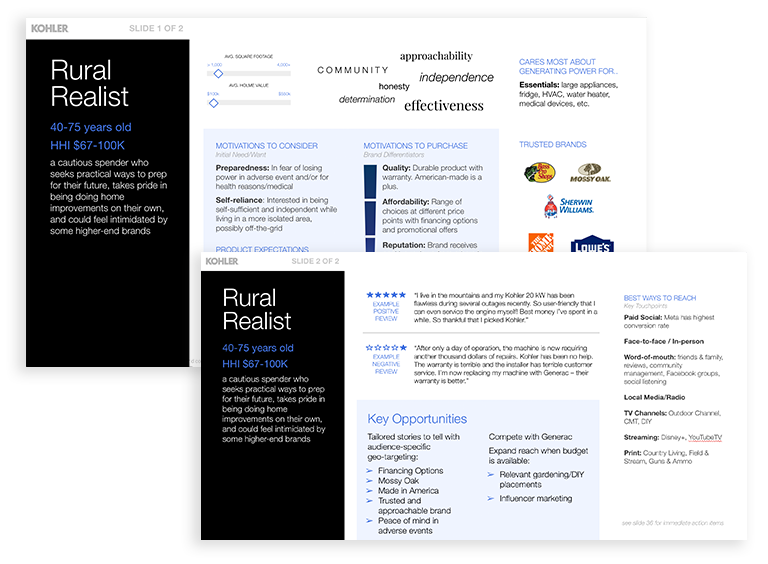

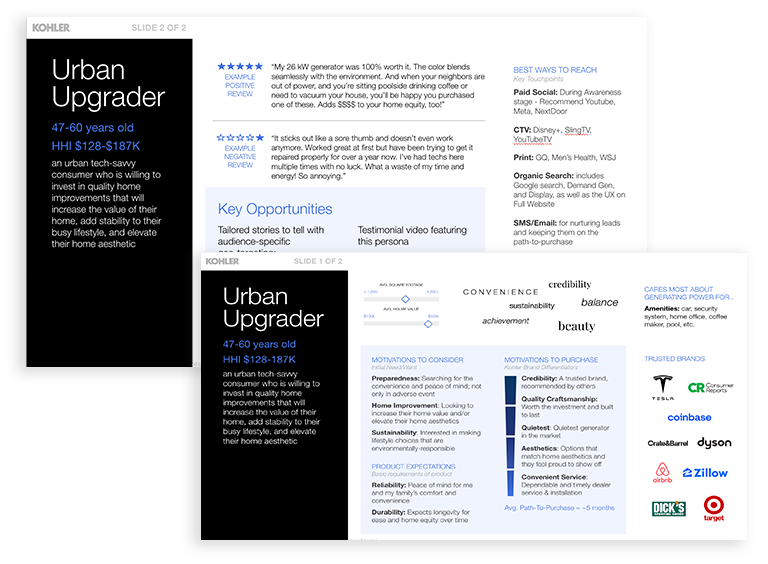

To evolve how we referenced and conceived of our audience segments, we needed to expand on our demographic data with informed assumptions, diving deeper into each group’s motivations and core values. Evidence-based persona-building requires a degree of empathy—placing ourselves in the shoes of our target audience members to truly understand their concerns, needs and behaviors. Armed with the outputs of our analysis and our empathetic consumer awareness, we newly defined our two clusters as the “Urban Upgraders” and “Rural Realists.” Let’s break down their personas:

The Urban Upgraders, formerly referenced as our higher household income group, seek to invest in home improvements that add convenience, increase their home’s value and elevate their aesthetic. They’re willing to pay a premium to attain such convenience and quality—as long as the product is reliable and aesthetically appealing. Brand trust plays a role in their purchasing habits; when they can rely on the brand, they can rely on the product. This group also considers the environmental-friendliness of a potential purchase, a sentiment in line with their attention to home value, as homes with eco-friendly upgrades fetch more in today’s market.

The Rural Realists, our income group operating at a slightly lower level than the Urban Upgraders, are looking for practicality above all, but certain principles fuel their spending habits. For example, the Rural Realist is more likely to be interested in purchasing an American-made product than their urban counterparts. These individuals tend to pay more attention to product affordability and expect longevity out of a more expensive purchase. They spend with an eye toward the future, looking to prepare their home and their family for the unexpected.

Step 4

Incorporating Audience-Specific Messaging into Our Media Strategy

More efficient lead generation requires both tailored messaging and strategic deployment—our data analysis gave us options for both.

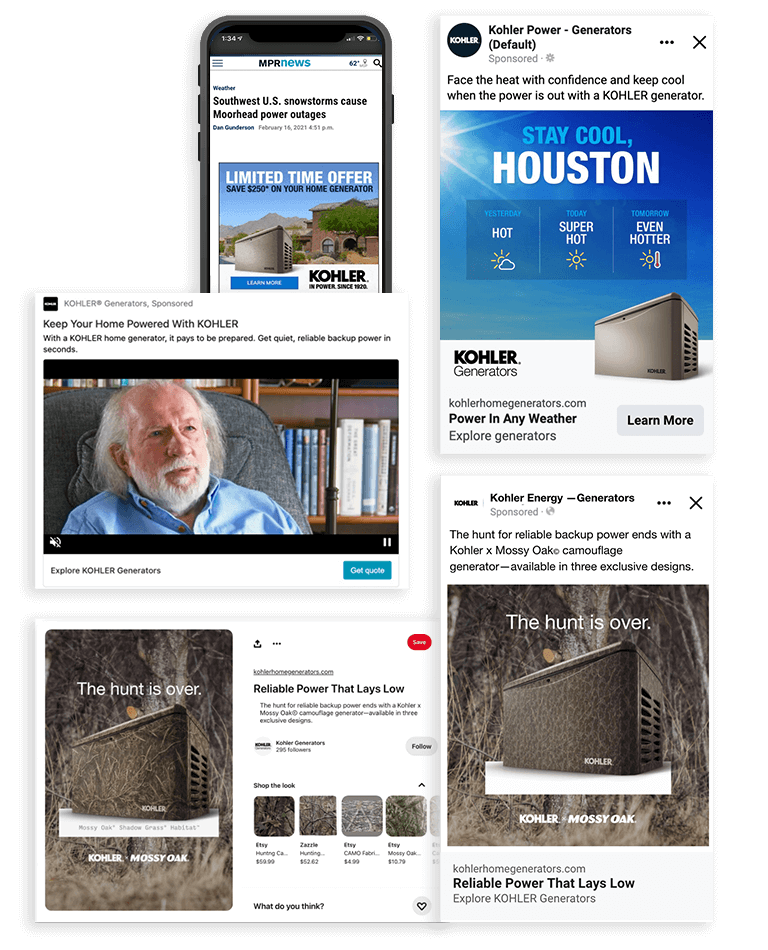

For our Urban Upgraders, we led with messaging around the increased home value and convenience a KOHLER home generator can provide. We chased this with push campaigns emphasizing secondary selling points like low noise level and the ability to charge an electric vehicle, guiding these audience members closer to conversion with a lower spend.

We focused on building brand trust with the Rural Realists, using messaging that communicated the unique peace of mind that comes with a backup power solution from KOHLER Home Energy. Push campaigns for this audience highlighted financing options and American manufacturing.

We also capitalized on assets born out of a partnership with Mossy Oak: generators available in three camouflage patterns. This stylized product was significantly more attractive to rural, preparedness-minded customers and allowed us to garner more purchasing interest quickly when paired with our hyper-specific targeting strategies.

The Results

Proving Our Approach Through Low-Funnel Results

Following deployment of an intricately refined audience and geo-targeting paid media strategy, year-over-year low-funnel metrics improved significantly: cost per appointment improved by 22%, cost per sale is projected to improve by 20% and sales are projected to grow by 3%—even with a 20% decrease in media budget.

Ultimately, our approach to informed audience segmentation not only allowed us to refine our audience and get more surgical with targeting and creative assets, it allowed us to drive more sales for less.

22% Lower Cost Per Appointment

20% Lower Cost Per Sale